October 25, 2013

The health insurance programs for the State of Illinois’ retired public school teachers outside of Chicago and downstate community college employees face mounting backlogs of unpaid claims as costs continue to outpace revenues, according to a recent report.

The report, by the legislature’s Commission on Government Forecasting and Accountability, (COGFA) examines the financial condition of the Teachers’ Retirement Insurance Program (TRIP) and the College Insurance Program (CIP). As required by law, COGFA issues annual reports on the State Employees Group Insurance Program, which covers employees, retirees and dependents of the State government, State universities, the General Assembly and the judiciary. However, this was COGFA’s first report on TRIP and CIP since July 2009.

According to the latest COGFA report, TRIP covered 73,472 retired teachers and their dependents in FY2013, while the much smaller CIP covered 6,556 community college employees and dependents. The programs are administered by the State’s Department of Central Management Services (CMS) and funded mainly from premiums paid by retirees and contributions from the State, employers (school districts and community colleges) and active employees.

In July 2009, COGFA warned that TRIP and CIP were in danger of becoming insolvent because costs were growing faster than funding sources. The report predicted a deficit of $81.3 million at TRIP and $10.9 million at CIP on June 30, 2011.

The programs have avoided that fate largely by delaying payment of health insurance claims. In addition, the State made a special contribution of $36 million to CIP in FY2013 to pay down some of the accumulated claims.

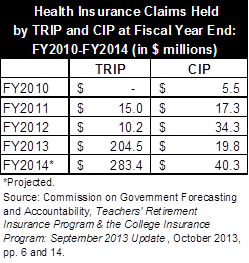

The following table, based on data that COGFA obtained from CMS, shows the increase in unpaid claims for CIP and TRIP from FY2010 to FY2013 and projected unpaid claims for FY2014. CMS uses the term “claims hold” to refer to unpaid claims. Unpaid claims for both programs are expected to total $323.7 million at the end of FY2014, up from $5.5 million at the end of FY2010.

TRIP and CIP hold claims at the end of the fiscal year because funding is not sufficient to pay the bills. The $283.4 million in projected claims held by TRIP at the end of FY2014 represents 56.7% of estimated FY2014 revenues of $500.0 million. CIP’s projected year-end claims of $40.3 million represent 76.2% of estimated FY2014 revenues of $52.9 million.

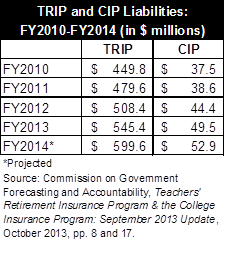

The next table shows the annual cost of operating the two programs from FY2010 to FY2013 and projected costs in FY2014. TRIP’s liabilities are projected to increase by $149.8 million, or 33.3%, to $599.6 million in FY2014 from $449.8 million in FY2010. CIP’s liabilities are projected to increase by $15.4 million, or 41.1%, to $52.9 million in FY2014 from $37.5 million in FY2010.

The increase shown above is due to both medical inflation and enrollment growth. The number of TRIP participants is expected to increase by 14.2% to 76,006 in FY2014 from 66,551 in FY2010. The average annual cost per TRIP participant is projected to rise by 16.7% to $7,889 in FY2014 from $6,758 in FY2010. For CIP, the number of participants is expected to grow by 22.9% to 6,917 from 5,629 and the average annual cost per participant is projected to increase by 14.7% to $7,645 from $6,665.

It should be noted that the liabilities and unpaid claims shown in the COGFA report do not include potential savings from the State’s decision to move Medicare-eligible participants into Medicare Advantage plans. Medicare Advantage plans are offered by private companies that contract with the federal government to provide Medicare benefits. Medicare-eligible participants in TRIP, CIP and the State group insurance program are scheduled to be moved in January 2014 to Medicare Advantage plans that would also provide supplemental benefits similar to those offered by the existing insurance programs. CMS has estimated that the change will generate savings of more than $200 million over two years for the State group insurance program, but potential savings for TRIP and CIP have not been made available.

Annual State contributions to TRIP and CIP are specified in the State Employees Group Insurance Act of 1971. For TRIP, the State contribution for the coming fiscal year must match estimated active member contributions (with an adjustment for estimation errors in the previous year’s calculation). The State’s contribution to CIP is set at 0.5% of projected payroll for community college employees eligible to receive full-time benefits (adjusted for prior errors). The Teachers’ Retirement System (TRS) and State Universities Retirement System (SURS) certify the required annual contributions.

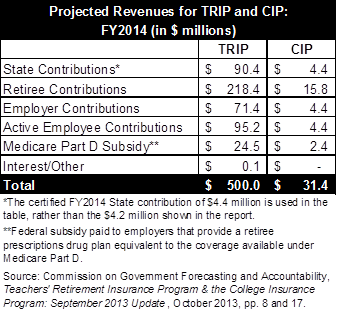

Although the FY2014 required contributions were $90.4 million for TRIP and $4.4 million for CIP, the Illinois General Assembly appropriated only $62.6 million for TRIP and nothing for CIP. The certified amounts will be paid, however, because the State contributions to the two programs are subject to continuing appropriation.

As shown in the next table, retirees represent the largest single source of funding for both programs. TRIP retirees pay 25% of the total insurance premium determined by CMS if they choose a managed care plan and 50% if they choose a traditional insurance plan. There is an exception for retirees without access to a managed care plan—largely out-of-state retirees—who pay only 25% of the premium for traditional insurance coverage. TRIP dependents receive subsidies if they are covered by Medicare. CIP retirees pay as little as 25% of the total premium cost, but premiums for their dependents are not subsidized. For both TRIP and CIP, retirees’ premiums are not permitted to increase by more than 5.0% a year.

The recent COGFA report concludes that TRIP and CIP cannot be financially stable unless costs are reduced or revenues increased. The report also mentions the possibility of shifting TRIP and CIP participants to the new health insurance exchange established under the federal Affordable Care Act.

TRIP and CIP are considered to be cost-sharing multiple-employer postemployment benefit plans, in which costs are shared by participating employers. The latest actuarial valuation reports for TRIP and CIP are on COGFA’s website. Relevant accounting standards (Governmental Accounting Standards Board No. 43) do not require that the State disclose the programs’ unfunded liabilities in its financial reports, and unpaid end-of-year claims of TRIP and CIP are not considered to be General Funds liabilities. As of June 30, 2011, TRIP and CIP had unfunded liabilities of $18.9 billion and $2.1 billion, respectively.

In contrast, the state group insurance program is primarily sponsored by the State. Accounting standards (Governmental Accounting Standards Board No. 45) require that its unfunded liabilities be disclosed in the State’s financial reports. The unfunded liability stood at $33.3 billion as of June 30, 2011. Unpaid group health insurance claims at the end of the fiscal year are a General Funds liability of the State. As discussed here, that claims backlog is expected to remain at roughly $1.5 billion at the end of FY2014.